mortgage refinance transfer taxes

70 cents per 100 Documentary Stamps State Tax on the Deed 35 cents per. Florida Mortgage Refinance Transfer Taxes Oct 2022.

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

The transfer tax is 06 of the higher of.

. Florida Mortgage Refinance Transfer Taxes - If you are looking for lower monthly payments then we can provide you with a plan that. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. A transfer tax is a real estate tax usually paid at closing to facilitate the transfer of the property deed from the seller to the buyer.

Transfer tax exemptions are not common but they do occur. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. How much are transfer taxes.

2400 12 680 034 None. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage. Transfer taxes are not tax-deductible.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. Mortgage calculator with insurance pmi home. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

Some more popular cities tend to charge additional. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. Homebuyers aged 18 to 35 who buy their first property worth up to 400000 can benefit from an exemption of the 2 transfer tax.

How to Pay Closing Costs When Refinancing Your Mortgage. In a refinance transaction where property is. Gift - This must be a bona fide legitimate gift.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. So if you have a 750000 mortgage on your primary home and 250000 mortgage on a vacation home you can deduct all your mortgage interest. That doesnt change after refinancing so you.

Purchasing A Home In Florida Florida Refinance. State Transfer Tax is 05 of transaction amount for all counties. The only government fee you will pay on refinancing a home in Delaware is the recording fee to the county for recording the new mortgage.

It might also be added that apparently there is a transfer tax if. Mortgage Refinance Calculator With Taxes - If you are looking for a way to reduce your expenses then our trusted service is just right for you. Therefore no new deed transfer taxes are paid.

New York 2000. Both the seller and the buyer are liable for the transfer tax but it is normally agreed between the parties that the transfer tax is paid by the buyer. Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal Income Tax should be.

This is because a cash-out refinance is essentially a brand-new mortgage making it costlier to process. The average transfer tax is 1 to 3 per 1000 of the sales price but some areas add additional transfer taxes on top of the base costs. Delaware technically doesnt have a transfer tax it.

Therefore no new deed transfer taxes are paid. In contrast to a property transfer Maryland State law. State laws usually describe transfer tax as a set rate for every.

You need fewer savings to close your mortgage and you can. Depending on where you live you may have to pay transfer. Quicken Loans was once again named to FORTUNE.

For example in Michigan state. Real estate mortgage calculator new american funding mortgage calculator mortgage calculator maryland with taxes mortgage rate calculator how to pay off mortgage early calculator. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the.

Transfer Tax In A Refinance Transaction Property Legal Counsel

What Is A Transfer Tax When The Tax Man Crashes Your Home Sale Valuepenguin

Tax Deductions For Reverse Mortgage Borrowing Payments

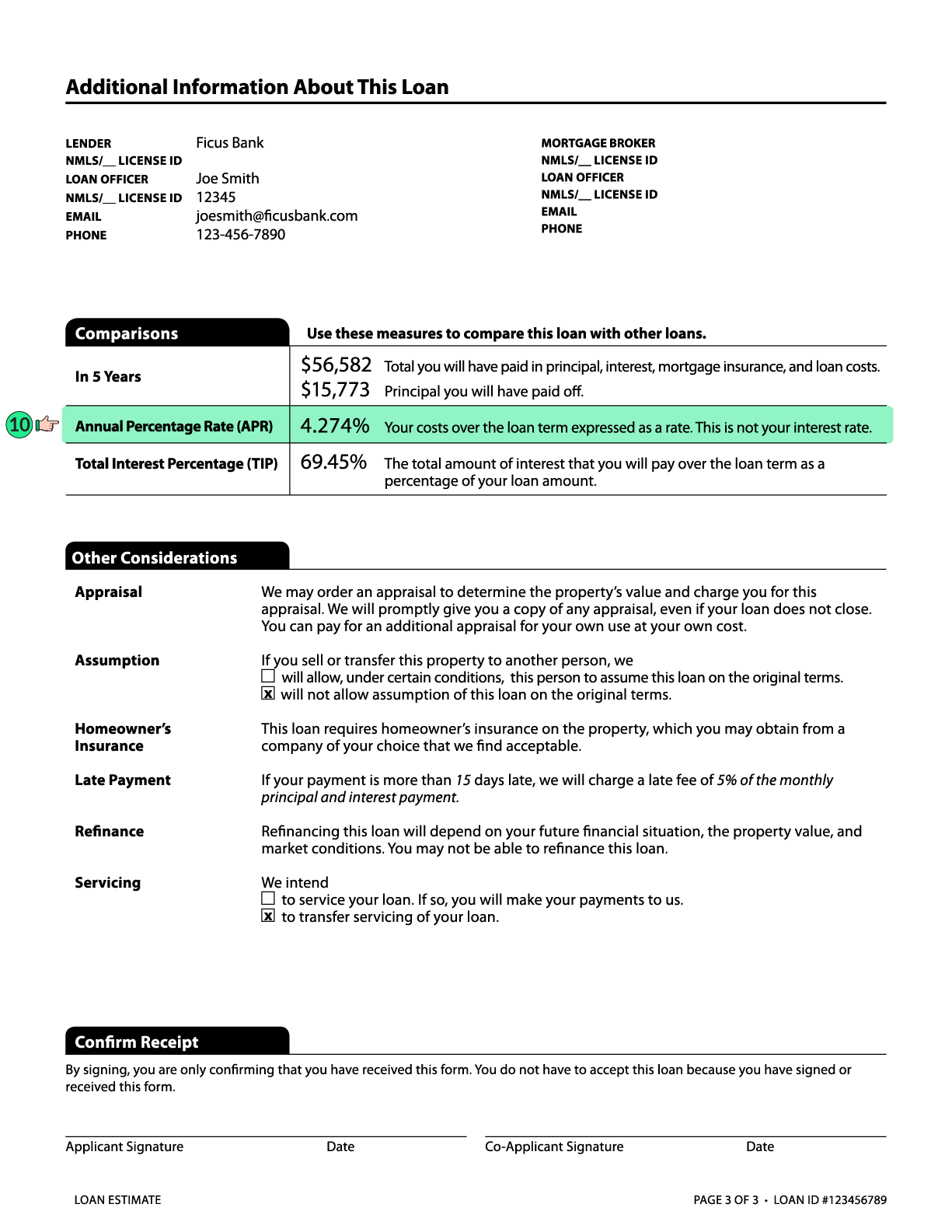

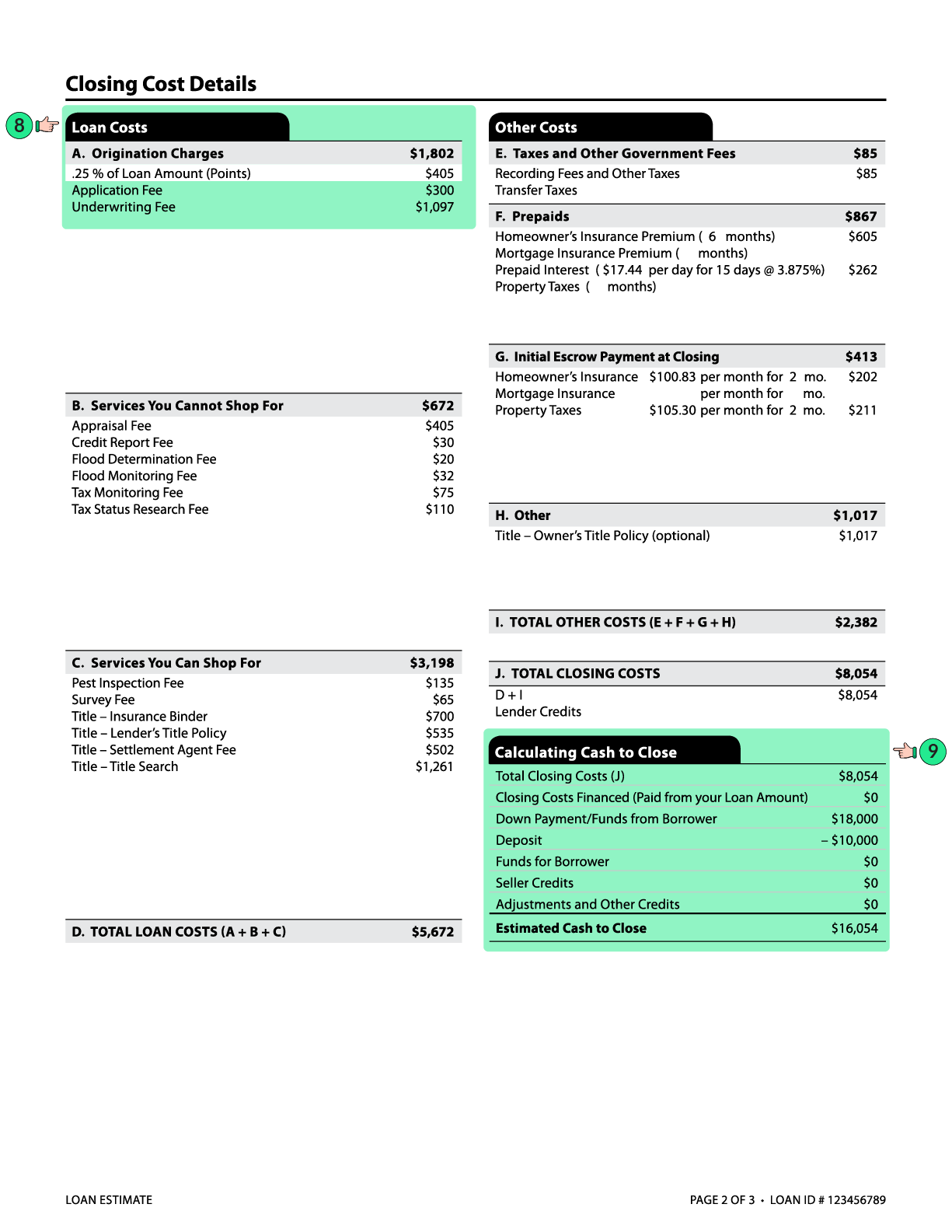

What Is A Loan Estimate How To Read And What To Look For

Best Mortgage Refinance Companies Of November 2022 Compare Refinance Rates U S News

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

About Your Mortgage Loan Servicing Transfer Freedom Mortgage

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Loan Estimate How To Read And What To Look For

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Best Mortgage Refinance Lenders Of November 2022 Nerdwallet

Closing Costs For Home Sellers Bankrate

Best Refinance Lenders Of November 2022 Refinance Your Mortgage With The Best

A Consumer S Guide To Mortgage Refinancings

Mortgage Refinance Calculator Excel Etsy

Cash Out Refinance Tax Implications Nextadvisor With Time

What Are Real Estate Transfer Taxes Bankrate

Homebuyer Tax Credit Mcc Idaho Housing And Finance Association